Would you engage with a financial services brand that you did not trust? I know I wouldn’t. Instinctively, we know that trust is the foundation of financial transactions. Brand trust is also linked to desirable indicators like familiarity and brand loyalty. Why else would trust be at the heart of so many value propositions and brands?

Trust is practically a buzzword in financial services. And yet, for a term thrown around so often by firms and leaders, explaining definitively what trust is is ironically complex.

Trust between two people differs from trust between a customer and a company. Dig a little deeper and even the nature of trust across industries can be drastically different. What, then, does it take for consumers to trust a financial services brand and what can those in the industry do to inspire and strengthen that trust?

Trust in financial services—by the numbers

According to Morning Consult’s 2022 Most Trusted Brands report, financial services ranked behind only healthcare in the list of industries where trust and honesty were deemed as most important to consumers.

However, financial services had a different placement in the ranking of the most trusted institutions and industries in the US. With 63% of respondents saying they trusted financial services, the industry ranked 4th, behind small businesses (77%), food & beverage (72%), and healthcare (64%). The percentage is also down compared to last year’s report (72%).

The disparity suggests a key opportunity for financial services firms and institutions to improve the trust between themselves and their customers. At the very least, it emphasizes how critical it is for these brands to keep the level of trust from falling any lower.

After all, second chances within this industry are rare—only 17% of respondents reported that they would re-consider a financial service provider that broke their trust. As the report states, “Among adults who have ended such relationships over broken trust, 29% say a financial services brand was involved, the highest share of any industry.”

What affects brand trust?

Perhaps the reason why trust can be so difficult to define is because of how nuanced it is.

Most of us may be able to agree that brand trust is all about the confidence that consumers have in a brand’s ability to meet (positive) expectations. Except, that kind of definition isn’t actionable. You can’t meet your customer’s expectations if you don’t understand what they are and how they came to be.

Establishing trust involves understanding what expectations matter the most—something that isn’t universal and can vary from person to person, industry to industry, and so on.

Establishing trust involves understanding what expectations matter the most.

For instance, a nonprofit dedicated to environmental conservation would likely be harshly critiqued for its own negative environmental impact yet forgiven for an accidental data leak. On the other hand, mismanagement of private data would be catastrophic for a financial services firm while its environmental impact is less likely to be a concern.

Ultimately, there’s a never-ending list of decisions and events that could impact consumers’ trust in a brand. Generally, though, brand trust is affected by developments that pertain to a brand’s:

- Product or service quality

- Perceived price-quality ratio

- Customer service and experience

- Handling of customer information

- Alignment with social and political values

- Consistency and reliability (or lack thereof)

- Level of transparency

Brand trust in financial services

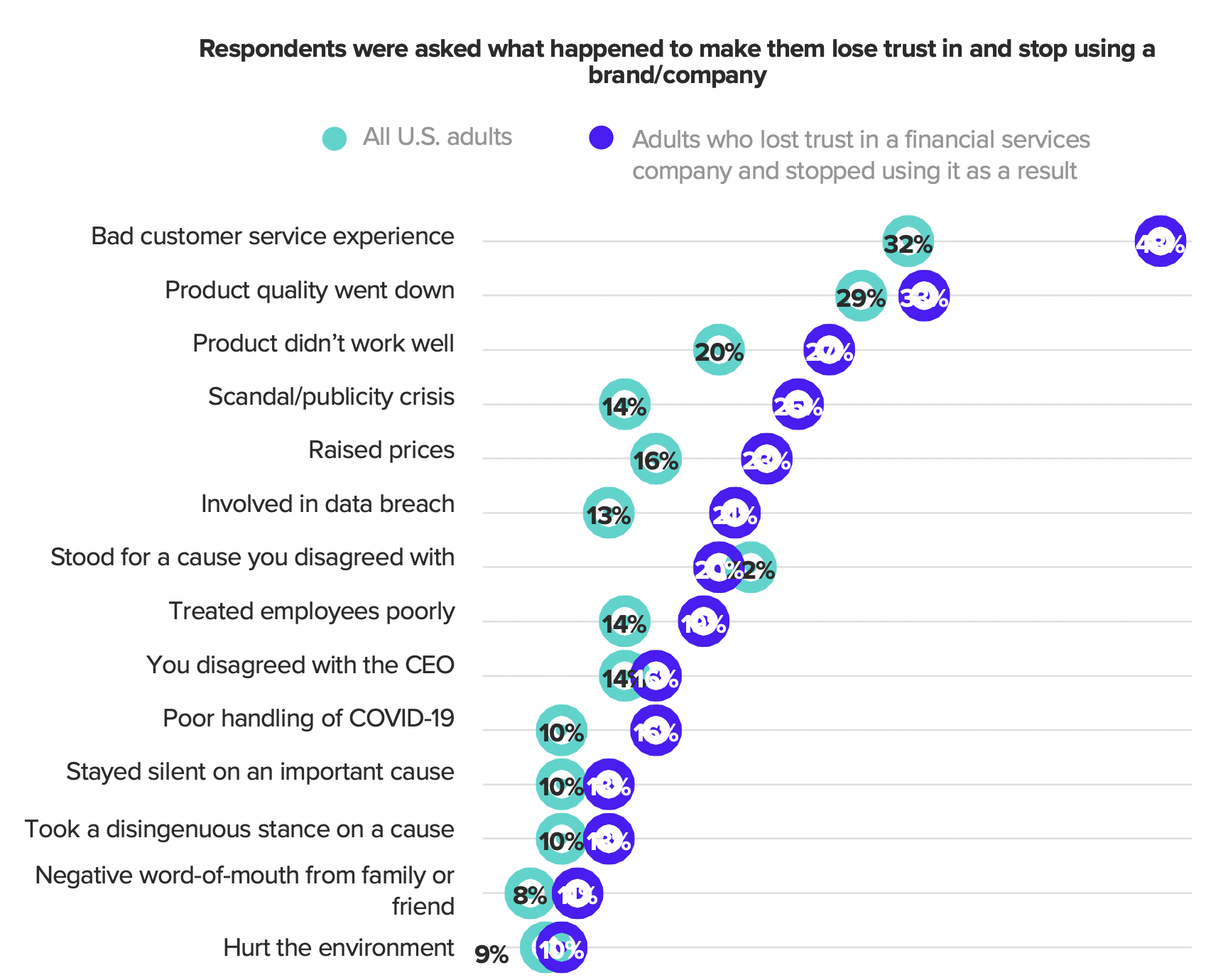

As discussed, how important a particular development is will depend on the consumer base. For the financial services industry, we can take a look at Morning Consult’s survey results below to get an idea of what matters the most to its customers.

In this graphic, you can see the top reasons U.S. adults lost trust in and stopped using a financial services company, as well as compare it to the results for all brands and companies (i.e., not industry-specific).

With the top reasons clearly organized from most common to least, financial services brands can get an insightful look into what issues have affected their customers’ trust the most.

Another interesting observation we can make is about the issues that seem to matter more to financial services consumers than consumers as a whole. Take a look at the differences between the percentages of “All U.S. adults” and “Adults who lost trust in a financial services company and stopped using it as a result.” Which reasons are more significant in this industry?

For example, bad customer service from a financial services provider isn’t just the most common reason for lost trust and discontinued use. It’s also the issue with the biggest discrepancy between the two segments. In other words, bad customer service seems to negatively affect financial services customers (48%) more than customers in general (32%).

Ranking the issues based on the percentage differences, the top five issues that impacted consumers of financial services more than consumers as a whole were:

- Bad customer service experience (16-point difference)

- Scandal/publicity crisis (11-point difference)

- Involved in data breach (8-point difference)

- Product didn’t work well (7-point difference)

- Raised prices (7-point difference)

Of course, this isn’t to assert that every institution or firm in the industry is affected by these issues equally. If you happen to be a financial services brand that differentiates itself based on a commitment to environmental causes, then there’s a good chance that any move that “hurt the environment” would hugely affect your customer’s trust.

Overall, though, studies like these help to give companies actionable insights into what it takes to keep the trust of their customers. For financial services brands, maintaining high-quality service and products, as well as staying out of scandals and strengthening data security, will go a long way in getting their customers to trust them.

Next steps to establishing brand trust

Trust is a delicate thing that can be broken or built up at any time. And it’s one of the most important aspects of building a brand and maintaining customer loyalty.

While industry studies can be helpful for big-picture analysis, research centered around your unique organization is undeniably critical. In our work with brands, a big part of our process involves thorough research of your specific customer base.

Our qualitative research methodology uses in-depth projective interviews with key target groups. This is how we discover what your customers need—what they value most and expect from a trusted financial services brand. From there, we figure out where your competitive advantage is: where does your offer intersect most naturally with what the audience needs?

This research, along with internal insights through our Brand Discovery workshop, lays the foundation for every powerful brand we’ve helped craft. Learn more about our process here or check out how we’ve helped financial services companies like Intelligent 401k build their brand from the ground up.

Graphic from Morning Consult’s report

Ask for help.

We are kind, thorough and ready when you are. You just need to ask.